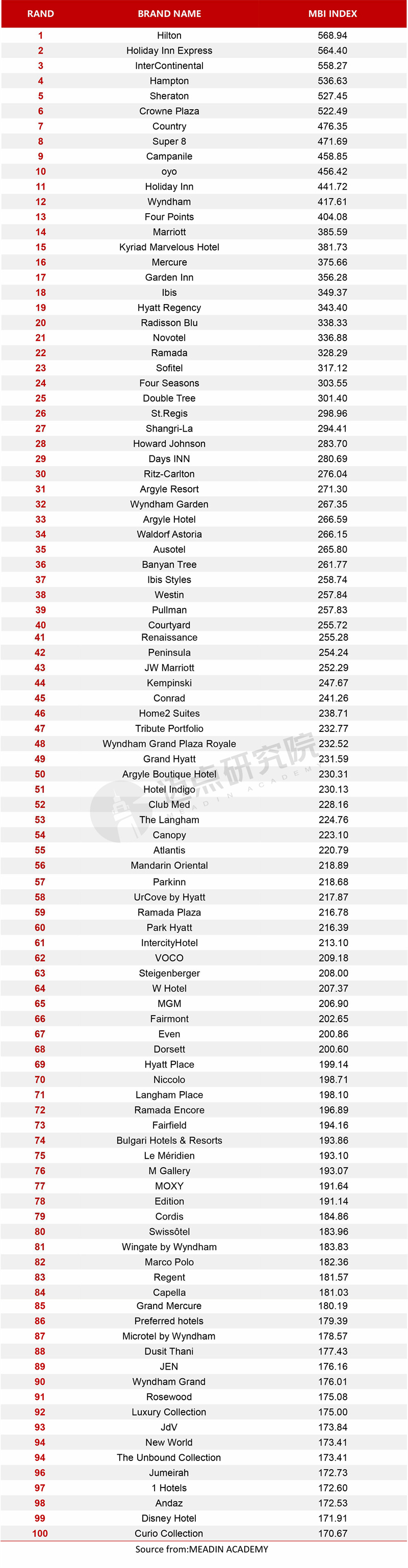

迈点研究院:2024年6月TOP 200全球酒店品牌(大中华区)排名(英文版)

Recently, the Meadin Academy Research Institute released the "TOP200 Global Hotel Brands (Greater China) in June 2024." Among them, hotel brands such as InterContinental, Hampton, Hilton, Crowne Plaza, Holiday Inn Express, Holiday Inn, Sheraton, Marriott, Super 8, and Country ranked in the top ten of the overall list. A newcomer to the list was URBN Boutique, ranking at 199th place.

From a brand perspective: Data shows that the average index for the top 10 brands is 523.74, for the top 100 brands it is 268.34, and for the top 200 brands it is 209.33. Sequentially, these represent increases of 1.87%, 0.45%, and 0.01% respectively. The data indicates a significant development trend among leading international hotel brands, with Holiday Inn and Marriott showing robust growth dynamics, far surpassing industry averages with growth rates of 20.89% and 24.64% respectively, highlighting their market leadership and brand appeal. The average index for the top 10 brands is significantly higher than that for the top 100 and top 200, indicating increased brand concentration and a market trend towards higher-end and quality-focused offerings.

Overall, the international hotel market is undergoing a transformation marked by brand reshaping and intensified competition, where brand strength emerges as a critical factor driving performance growth. Against this backdrop, each brand needs to continuously innovate services and strengthen brand characteristics to address market challenges and capture more market share.

From a group perspective: 1. Regarding group brand numbers—Marriott International, Wyndham Hotel Group, Accor Group, Hyatt Hotels Corporation, InterContinental Hotels Group, Hilton Worldwide, Radisson Hotel Group, Langham Hospitality Group, Louvre Hotels Group, Banyan Group have multiple brands listed in the top 10, with 22, 15, 15, 11, 11, 10, 7, 5, 5, and 5 brands respectively. Additionally, this month saw a slowdown in hotel group expansions, with only CHR Hotels & Resorts adding 1 new hotel, marking a period of stable market adjustment. 2. Regarding group brand indices—This month, hotel group brand indices showed a differentiated trend, with 47% of hotel groups experiencing month-on-month growth and 53% experiencing declines. Notably, Fosun Tourism Group and Pan Pacific Hotels Group performed exceptionally well, with brand index increases of 58.32% and 30.92% respectively, demonstrating strong brand vitality and market competitiveness. This reflects the uneven development of hotel industry brands, with only a few groups achieving rapid growth through optimized strategies and innovative services.

MEADIN Brand Index(MBI) - Brand Value Inquiring Platform

MEADIN Brand Index (MBI) mainly analyzes the brand's communication power in the Internet from three dimensions: media index, comment index and investment index. This is a free data analysis service provided by the Meadin Brand Index Monitoring System (MBIMS), which is independently developed by MEADIN ACADEMY.

Calculation formula: MBI=a * MI+b * CI+c * II

Note: MBI refers to the MEADIN Brand Index (MBI data of a certain brand); a, b and c refer to the weighted coefficients in the system; MI (Media Index) refers to the media index; CI (Comment Index) refers to the comment index; II (Investment Index) refers to the investment index.

Note: Enterprises or individuals can refer to brand index data to monitor and predict brand development, but the MEADIN Brand Index cannot be completely equivalent to its brand development.

(1)Media Index (MI): The number of positive news related to brands’ keywords reported by major media, mass media, industry media, and self media over a period of time.

(2) Comment Index (CI): The accumulation relates to user reviews towards a certain brand’s opening hotels on various OTA (Online Travel Agency) websites over a period of time.

(3) Investment Index (II): Over a period of time, the franchise and development status of a certain brand in the Greater China market, including accumulative opening status, new opening status, accumulative signing status, new signing status, urban coverage density, investment owner attention, etc.

MEADIN ACADEMY – Culture and Tourism Industry Data Center

MEADIN ACADEMY has been engaging in buliding a Culture and Tourism Industry big data analysis platform, utilizing "data productivity" to change cognition and improve enterprise efficiency. It provides diversified big data solutions based on intelligence, data, and services for enterprises and public institutions which are looking forward to entering and expanding culture and tourism and rental real estate businesses. Transforming numbers into facts, the platform assists enterprises in making important decisions and identifying investment risks.